1XBet is a global sportsbook that is becoming increasingly popular in India due to its excellent cricket odds and promotional offers. With a wide variety of payment methods, 1XBet makes it easy for customers to deposit and withdraw funds. However, in order to protect its customers and ensure a safe and secure betting environment, 1XBet has implemented a rigorous KYC (Know Your Customer) procedure. This article will explain the 1XBet verification process and outline the documents that customers need to provide.

Why do I need to verify my 1XBet account?

The 1XBet KYC procedure is designed to protect both the customers and the company. This is done by verifying the identity of the customers and ensuring that the funds used for betting are acquired from legal sources. The 1XBet verification process also allows the company to detect any suspicious activity or fraud.

How to verify your 1XBet account

In order to verify your 1XBet account, you must provide certain documents. These include a valid official identification document that has a photograph of the holder, such as a driving license, identity card, travel-document or passport. Additionally, the company may also request proof of address, such as a recent utility bill, recent account statement or reference letter from a credit institution/financial institution.

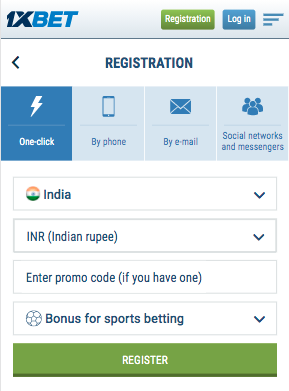

While it is not required, it is highly recommended to undergo the verification procedure prior to making a first 1XBet deposit as you can then argue that deposits have been made from a verified account. This should consequently also facilitate the 1xbet withdrawal procedure.

Which documents do I need to provide?

The 1XBet verification procedure requires customers to provide certain documents to confirm their identity and address. These include a valid official identification document that has a photograph of the holder, such as a driving license, identity card, travel-document or passport. Additionally, the company may also request proof of address, such as a recent utility bill, recent account statement or reference letter from a credit institution/financial institution.

The company also reserves the right to request additional documentation, such as proof of funds, to make sure players are using their own money when gambling at the site. Furthermore, the company may also request customer bets to be checked for possible violations. The company may also contact the provider to check the legality of the winning credited.

1XBet verification – our verdict

In conclusion, 1XBet is a very good international sportsbook that gains popularity in India due to its excellent cricket odds and promotional offers as well as broad variety in payment methods. However, the 1XBet verification process is quite rigorous and customers must provide certain documents to confirm their identity and address. Furthermore, the company reserves the right to freeze a customer’s account for financial procedure purposes during the verification process for up to 180 days, which could be highly inconvenient for customers.

1XBet KYC ID check – FAQ

The 1XBet KYC procedure is designed to protect both the customers and the company by verifying the identity of the customers and ensuring that the funds used for betting are acquired from legal sources.

The 1XBet verification procedure requires customers to provide certain documents to confirm their identity, such as a valid official identification document that has a photograph of the holder, and proof of address, such as a recent utility bill or account statement. The company also reserves the right to request additional documentation, such as proof of funds, to make sure players are using their own money when gambling at the site.

If the customer refuses to provide the documents requested by the Security team, any bonuses/winnings will be forfeited. The company reserves the right to take any reasonable measures, including but not limited to blocking the account and freezing the available funds until the account holder is established and their deposit methods have been confirmed.